Polish farmers have taken a stand against the influx of Ukrainian grain, staging demonstrations and dumping shipments from trucks and trains. Prime Minister Donald Tusk has attempted to reason with them, acknowledging the possibility that Poland’s border with Ukraine could be closed temporarily. Meanwhile, suspicions linger in Ukraine that these protests are orchestrated by Russia. Indeed, when it comes to any economic rationale, Polish farmers’ aversion to Ukrainian grain seems unfounded — the cheaper Ukrainian imports crossing into Europe by train and truck represent a small fraction of overall market share, one insufficient to significantly impact prices. A ban on imports won't resolve the Polish farmers' concerns, nor will it severely affect Ukraine’s agricultural sector, which is much more dependent on exports moving through the Black Sea.

Content

Drivers of discontent

Will closing the border make problems go away?

Sea export threatened

Russia remains a competitor

Localized protests in defense of farmers' interests have persisted in Poland since autumn. However, in February they erupted on a nationwide scale. One of the movement’s main grievances is directed at Ukrainian grain. On February 11, a group of unidentified people emptied grain from Ukrainian trucks near the border. This was followed by the removal of corn from two railway cars on February 20 and 160 tons from other cars on February 25. The farmers say they are discontented with the influx of cheap grain from neighboring Ukraine and have resorted to blocking checkpoints along the border.

“We want to help Ukraine. But we also want to protect our agricultural producers,” said Polish Prime Minister Donald Tusk during a meeting with protesting farmers. Tusk has repeatedly stated that he is ready to temporarily close the border with Ukraine. “I am ready for tough decisions when it comes to the border with Ukraine,” he affirmed. The unrest instigated by the farmers, which has included chainsaw attacks on trucks, grain spillage, road blockades, closure of the German border crossing, and the construction of an “Agro Abrams” tank made of straw, has compelled Tusk to contemplate such measures. The protesters are demanding either the removal of Ukrainian competitors or the implementation of subsidies for Polish producers.

Tusk is now also considering the possibility of banning the import of Russian grain, following Latvia's lead.

Drivers of discontent

Protests in Poland have been fueled by a multitude of grievances. However, the influx of cheaper Ukrainian grain is just the tip of the iceberg. According to the Polish newspaper Gazeta, “farmers are primarily calling for an abandonment of the EU's 'Green Deal,' which they fear will reduce the profitability of agricultural production.” Activists have even blocked a vital border crossing with Germany in Świeckounder the banner of stopping “eco-terrorism.”

EU regulations are also compounding the farmers' woes. They have been compelled to forego traditional fertilizers, resulting in decreased yields. Moreover, the adoption of new technologies including solar panels and energy-efficient materials necessitates significant investments, further burdening the agricultural sector. Similar sentiments are echoed by farmers across the EU, with protests erupting in France, Germany, Belgium, Greece, Italy, Latvia, and Lithuania. Each country, however, grapples with its unique challenges. In France, for instance, there is a strong pushback against a proposed trade agreement with MERCOSUR, a South American trade bloc.

Meanwhile, Ukrainian suppliers have added fuel to the fire. In the wake of Russia's full-scale invasion in 2022, the EU abolished all duties and quotas on the import of Ukrainian food and agricultural products. This, coupled with simplified freight transportation between the EU and Ukraine, led to a surge in Ukrainian trucks in Eastern Europe.

However, the tide quickly turned. In May 2023, the European Commission decided to temporarily restrict imports from Ukraine, targeting four key agricultural products: wheat, corn, rapeseed, and sunflower seeds. Initially intended to remain in effect only until June, the ban was later extended to September to coincide with the new harvest season. The lifting of restrictions and the subsequent return to preferential treatment for Ukraine sparked outrage in Poland, prompting locals to take matters into their own hands by blocking the import of grain.

The director of a company involved in transporting Ukrainian grain to the European Union revealed to The Insider that, at least in the early days of the protests, some vehicles carrying Ukrainian grain were still managing to pass through. However, when Rafal Mekler — the owner of eponymous transportation company Rafał Mekler Transport — became involved, a complete blockade went into effect.

“Exports and transit through Poland have practically been halted,” remarked Maria Belikova, an analyst at the Ukrainian office of Fastmarkets Agricensus. “Polish farmers have been blocking several key border crossing points since November, except for a break before the New Year.”

With the ongoing war, anything related to Ukraine is under intense scrutiny. Polish farmers may be acting with this in mind, deliberately refusing to allow the passage of Ukrainian grain not for direct economic reasons, but rather to draw attention to their own problems.

The protests and attacks on carriers of Ukrainian grain are seen as a consequence of a political struggle, according to The Insider's source in the Ukrainian embassy in Poland. The Security Service of Ukraine (SBU) is confident that the organizers of the protests are connected to Russia. Lviv Mayor Andriy Sadovyi directly referred to those who spilled Ukrainian grain from trucks at the border as “pro-Russian provocateurs.”

Will closing the border make problems go away?

No, because Ukrainian grain only represents a small portion of the Polish market. “In 2022, Poland produced 24.8 million tons of grain. In comparison, Ukrainian transit accounted for about 11%, and in 2023, only 0.02%,” explains Belikova. According to her calculations, based on customs statistics, Ukraine exported a total of 2.7 million tons of grain to Poland in the last agricultural year (from July 2022 to June 2023) and only 46,000 tons in just over 7 months of the current agricultural year.

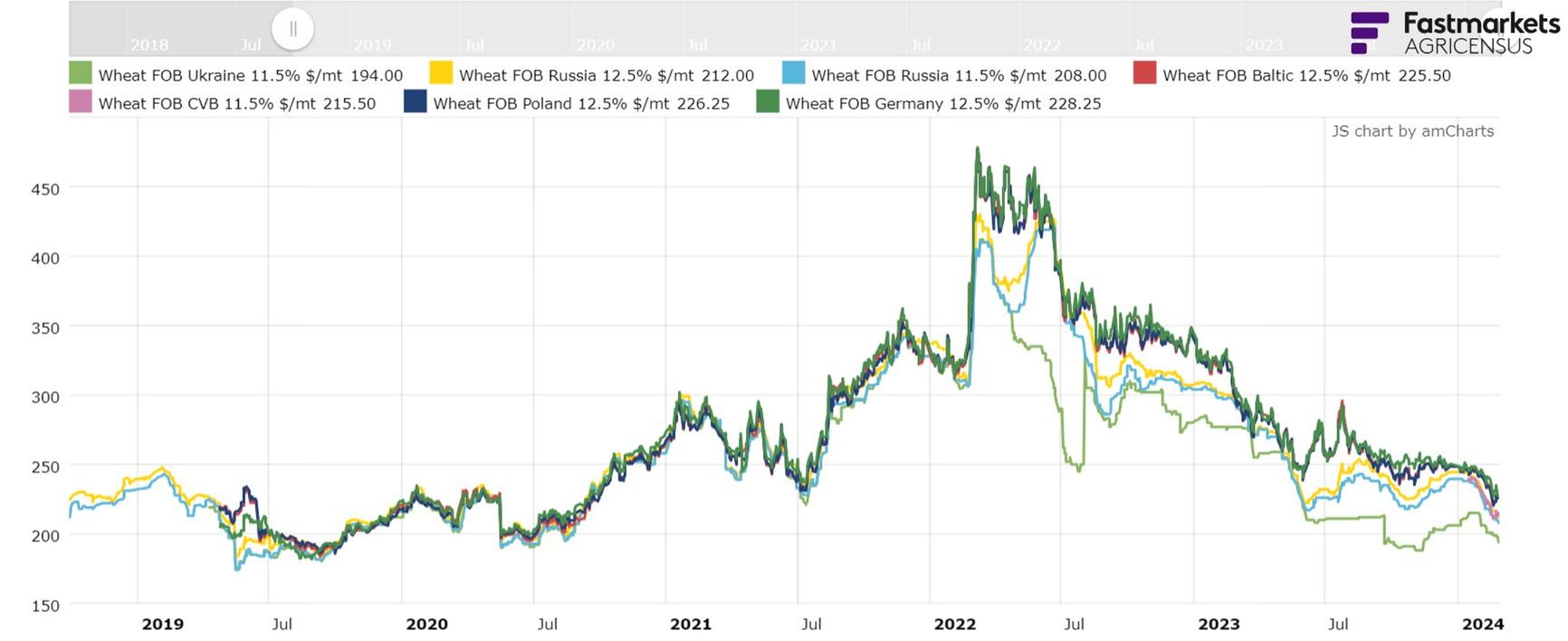

The challenges for European farmers go beyond the increase in expenses due to EU requirements — they also involve a decrease in grain prices. However, the price decline is a global trend and is not directly linked to the preferential treatment of Ukrainian shipments. Following the outbreak of the war, prices surged due to concerns about lost shipments from both major grain exporters in the Black Sea region: Ukraine and Russia. The Economist even predicted a food catastrophe and famine. But by May 2022, when this notable article was published, policymakers had already shifted their focus to implementing a “grain deal,” which stabilized the market and led to a decline in prices. This downward trend has continued for a year and a half and has resulted in prices noticeably lower than pre-war levels. The global market currently faces an oversupply due to high yields from major suppliers.

The Southern Common Market, commonly known by Spanish abbreviation Mercosur, and Portuguese Mercosul, is a South American trade bloc established by the Treaty of Asunción in 1991 and Protocol of Ouro Preto in 1994. Its full members are Argentina, Brazil, Paraguay and Uruguay. Venezuela is a full member but has been suspended since 1 December 2016.

The European Green Deal, approved in 2020, is a set of policy initiatives by the European Commission with the overarching aim of making the European Union climate neutral in 2050. The plan is to review each existing law on its climate merits, and also introduce new legislation on the circular economy, building renovation, biodiversity, farming and innovation.

Prices of wheat imported from Ukraine, Russia, and other countries (net of transportation costs), in $ per ton as of February 28th

However, for Ukraine, the Polish border no longer serves as a primary route for exporting agricultural products. Currently, 86% of its exports are transported by sea. The remaining portion — railway (11%) and road transport (3%) — mostly passes through Romania, according to Belikova.

Nevertheless, certain Ukrainian companies will suffer. Poland and the EU as a whole remain an attractive option for small businesses that lack sufficient grain to transport to ports, and the shipments to Europe serve as a quick and reliable means to earn foreign currency. “These are mostly very small companies that trade, for example, with Germany. The route through Poland is the shortest and most cost-effective option. Transporting by rail entails changing the gauge at the border, necessitating transshipment from one rail car to another, which is costly,” explains Belikova. “Moreover, road transport incurs numerous additional expenses. Therefore, the profit margin is small.” Consequently, Ukrainian sellers are unable to significantly reduce prices.

Sea export threatened

The export of grain by sea holds paramount importance for Ukraine, constituting 86% of all its foreign shipments, with 76% passing through Black Sea ports. Initially made possible thanks to the Black Sea Grain Initiative, which remained in effect from July 2022 to July 2023, shipments by sea were later facilitated by the efforts of the Ukrainian army, particularly the units responsible for maritime drones. During the deal's tenure, Ukraine's agricultural exports nearly reached their pre-war levels of 6 million tons per month. However, immediately after the deal fell through, exports halved. Nevertheless, the Ukrainian Armed Forces managed to push back the Russian Black Sea Fleet and effectively cleared the way for merchant ships to resume regular operations.

As Belikova explains, “When the 'grain deal' was in place under the auspices of the UN and Turkey, ships simply sailed along a corridor, essentially in the middle of the Black Sea. Now, the corridor runs as close as possible to Romania and Bulgaria — the idea is to be as close to NATO countries as possible and as far as possible from open waters, where there could be missiles and mines.”

In December 2023 and January 2024, Ukrainian agricultural exports again returned to the 6 million ton level.

The war has severely degraded Ukraine’s manufacturing and metallurgical sectors, elevating the relative importance of agricultural products to the country’s overall economy. However, without new military assistance from the United States, Ukraine will struggle to defend the Black Sea shipping corridor, Ukrainian President Volodymyr Zelensky has cautioned. “I believe the route will be closed because it requires ammunition, air defense systems, and other equipment for its protection,” he stated. The US Congress is currently delaying a decision on providing $60 billion in additional aid to Ukraine.

Belikova shares similar sentiments. “This is a cry for help because, although we've managed to handle things ourselves and are exporting grain, if our air defense systems are disabled and we have nothing to replace them with, we won't be able to secure the corridor,” she explained. “And it's a significant advantage for businesses: the corridor has opened the way not only for grain but also for metal and fertilizers. Imports come into the country through it as well.”

Russia remains a competitor

Unlike oil and oil products, Russian grain has not faced international sanctions, and there hasn't been any voluntary abstention from its purchase due to the country’s invasion of Ukraine. Hence, Russia and Ukraine remain competitors in the agricultural sector. The war has had a direct impact on the amount of arable land available to each side, with Russian occupying forces still in physical control over swathes of fertile territory in Ukraine’s Zaporizhzhia, Kherson, Donetsk, and Luhansk regions.

For Ukraine, this represents significant losses — 5–6 million tons of oilseeds, accounting for about 7% of total production nationwide, according to Belikova. Approximately 25% of agricultural land (excluding the previously annexed Crimea) ended up under occupation or on the front lines after February 2022. However, given Russia’s immense size, these territorial “gains” represent a negligible addition.

Ukrainian and Russian grain are roughly equal in quality and fall under the same price category. “Buyers, if they see that prices in Ukraine and Russia are more or less the same, go to sellers in Russia and say that it's cheaper in Ukraine. Then they do the same thing in Ukraine. As a result, they buy at the most advantageous price,” Belikova explains.

Prices for Russian wheat, when delivered by sea FOB (Free on Board), are currently at their lowest since 2020, according to SovEcon. Russian export prices are decreasing in line with global market trends, and they have been further influenced by a revision of the minimum price recommended by the Russian Ministry of Agriculture. Moreover, Russian wheat stocks have set a new record — as of January 1, they amounted to 36.5 million tons.

“Stocks have exceeded last year's record levels against the backdrop of relatively sluggish exports in recent months,” reports SovEcon.

Flour processing enterprises have accumulated wheat — 14.7 million tons, which is 5% higher than last year's figure. Wheat stocks in agricultural organizations amounted to 21.8 million tons — 1% less than the previous year. Therefore, the decline in prices in Russia will continue, as record stocks are set to put further downward pressure on prices in the domestic market.

The Southern Common Market, commonly known by Spanish abbreviation Mercosur, and Portuguese Mercosul, is a South American trade bloc established by the Treaty of Asunción in 1991 and Protocol of Ouro Preto in 1994. Its full members are Argentina, Brazil, Paraguay and Uruguay. Venezuela is a full member but has been suspended since 1 December 2016.

The European Green Deal, approved in 2020, is a set of policy initiatives by the European Commission with the overarching aim of making the European Union climate neutral in 2050. The plan is to review each existing law on its climate merits, and also introduce new legislation on the circular economy, building renovation, biodiversity, farming and innovation.