Contrary to the popular idea that re-export through Asia has rendered sanctions against Russia ineffective, the statistics paint a less rosy picture for the Kremlin. Approximately 500 companies, primarily from China, the UAE, and Turkey, have been targeted by U.S. secondary sanctions, impacting trade. Imports from Turkey have dropped nearly 30% in six months, and about 80% of payments in yuan are being returned. Although Asian politicians assure the Kremlin of friendship and partnership, private businesses are increasingly avoiding risks. While sanctions do not completely isolate Russia internationally, they significantly hinder its purchase of investment equipment and dual-use goods, leading to economic degradation.

Content

An unexpected turnaround

Dwindling supplies

Half-hearted trade

Payments shall not pass

An unexpected turnaround

In early July, an unusual event took place in the sphere of maritime cargo transportation. It involved the Chinese vessel Wei Xiao Tian Shi, a 240-meter heavy cargo carrier built in 2019. The ship's flat platform is designed to carry extremely large structures, such as 100-150 meter-high supports for offshore wind turbines.

In late March, Wei Xiao Tian Shi left a Chinese port located on an island about 120 km south of Shanghai, carrying two modules for a liquefied natural gas plant. These modules, produced by a Chinese firm within the Wison conglomerate, resemble cube-shaped blocks intertwined with pipes, standing as tall as a 25-story building.

The ship was on its way to Murmansk, where it was scheduled to arrive by the end of May. There, at the assembly site in the village of Belokamenka, the modules were to be delivered to the Russian company Novatek. They were then to become part of Train 3 of the Arctic LNG 2 plant and to be transported, fully assembled, across two more polar seas to the eastern shore of the Gulf of Ob, reaching the Gydan Peninsula and the Utrenneye field, also known as Salmanovskoye.

The companies are: Bomesc Offshore Engineering, Penglai Jutal Offshore Engineering, Wison Offshore Engineering Module Development, Qingdao McDermott Wuchuan Module Development, Cosco (Qidong) Offshore Company.

Countries from which more goods were imported in the first quarter: India, Malaysia, and Thailand.

Trade balance is the difference between exports and imports. It has a surplus if exports exceed imports, and a deficit when imports exceed exports.

Train 2 of the Arctic LNG 2 plant. Sketch by the contractor, Chinese engineering company Wison. The modules transported on Wei Xiao Tian Shi are highlighted. The assembled train should include a total of 14 modules

After crossing three oceans and rounding Africa, the vessel reached Atlantic waters near Northwestern Europe, where it began to meander and circle. May and June passed, and despite being only a few days away from Murmansk, the modules never arrived. On May 1, 2024, the U.S. Treasury added Singaporean and Hong Kong shipowners, whose vessels had previously transported modules for Train 2 of Arctic LNG 2 to Russia, to the sanctions list. Nevertheless, on May 10, Wei Xiao Tian Shi continued its journey to Murmansk. On June 13, it was reported that Penglai Jutal Offshore Engineering Heavy Industries, the Chinese manufacturer of other modules for Arctic LNG 2, had also been subjected to sanctions.

Novatek found only five module suppliers in China for the mega-project on the Gydan Peninsula. These suppliers delivered two dozen modules for the first and second trains of Arctic LNG 2. One of these suppliers, Chinese Penglai Jutal, was hit by U.S. secondary sanctions on June 12. Wison's leaders, not wanting to take any chances, announced an immediate and complete withdrawal from all projects involving Russia. Consequently, on July 8, it was confirmed that the modules loaded on Wei Xiao Tian Shi were being turned around and sent back to China, and those waiting to be loaded would not be sent to Russia at all. Even the production site where they were assembled is set to be sold.

Ship tracking services show that Wei Xiao Tian Shi has already moved quite far from Murmansk and is now traveling along the Atlantic coast of Africa back toward the Cape of Good Hope.

The companies are: Bomesc Offshore Engineering, Penglai Jutal Offshore Engineering, Wison Offshore Engineering Module Development, Qingdao McDermott Wuchuan Module Development, Cosco (Qidong) Offshore Company.

Countries from which more goods were imported in the first quarter: India, Malaysia, and Thailand.

Trade balance is the difference between exports and imports. It has a surplus if exports exceed imports, and a deficit when imports exceed exports.

The Wei Xiao Tian Shi without cargo

Jiangsu Fanzhou Shipping Company

The turnaround exemplifies how Asian suppliers react when faced with the threat of U.S. secondary sanctions. Despite optimistic statements from politicians, primarily Russian, about reliable partnerships, companies prefer to avoid risks.

The companies are: Bomesc Offshore Engineering, Penglai Jutal Offshore Engineering, Wison Offshore Engineering Module Development, Qingdao McDermott Wuchuan Module Development, Cosco (Qidong) Offshore Company.

Countries from which more goods were imported in the first quarter: India, Malaysia, and Thailand.

Trade balance is the difference between exports and imports. It has a surplus if exports exceed imports, and a deficit when imports exceed exports.

When faced with the threat of U.S. secondary sanctions, Asian companies prefer to avoid taking risks

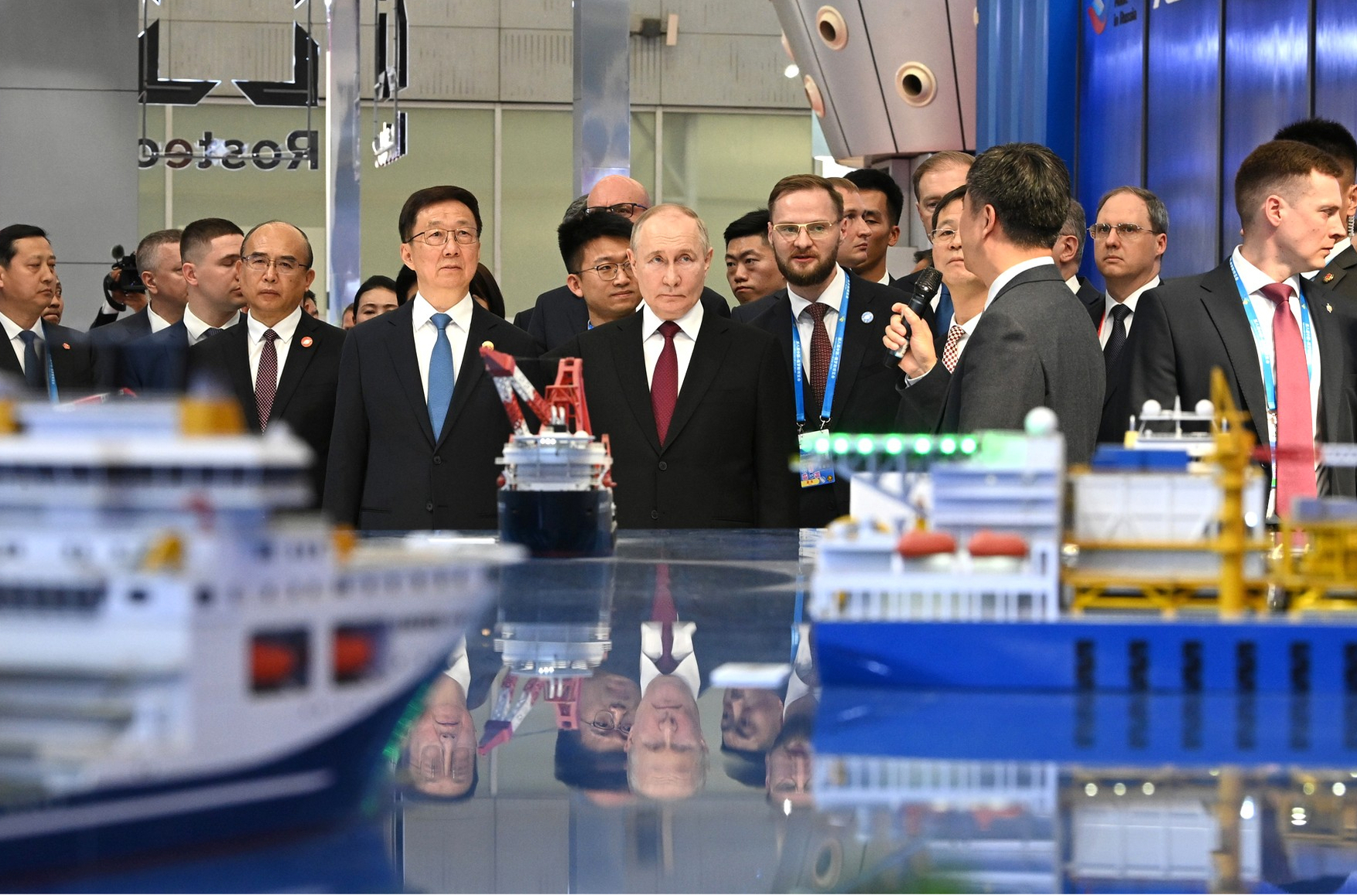

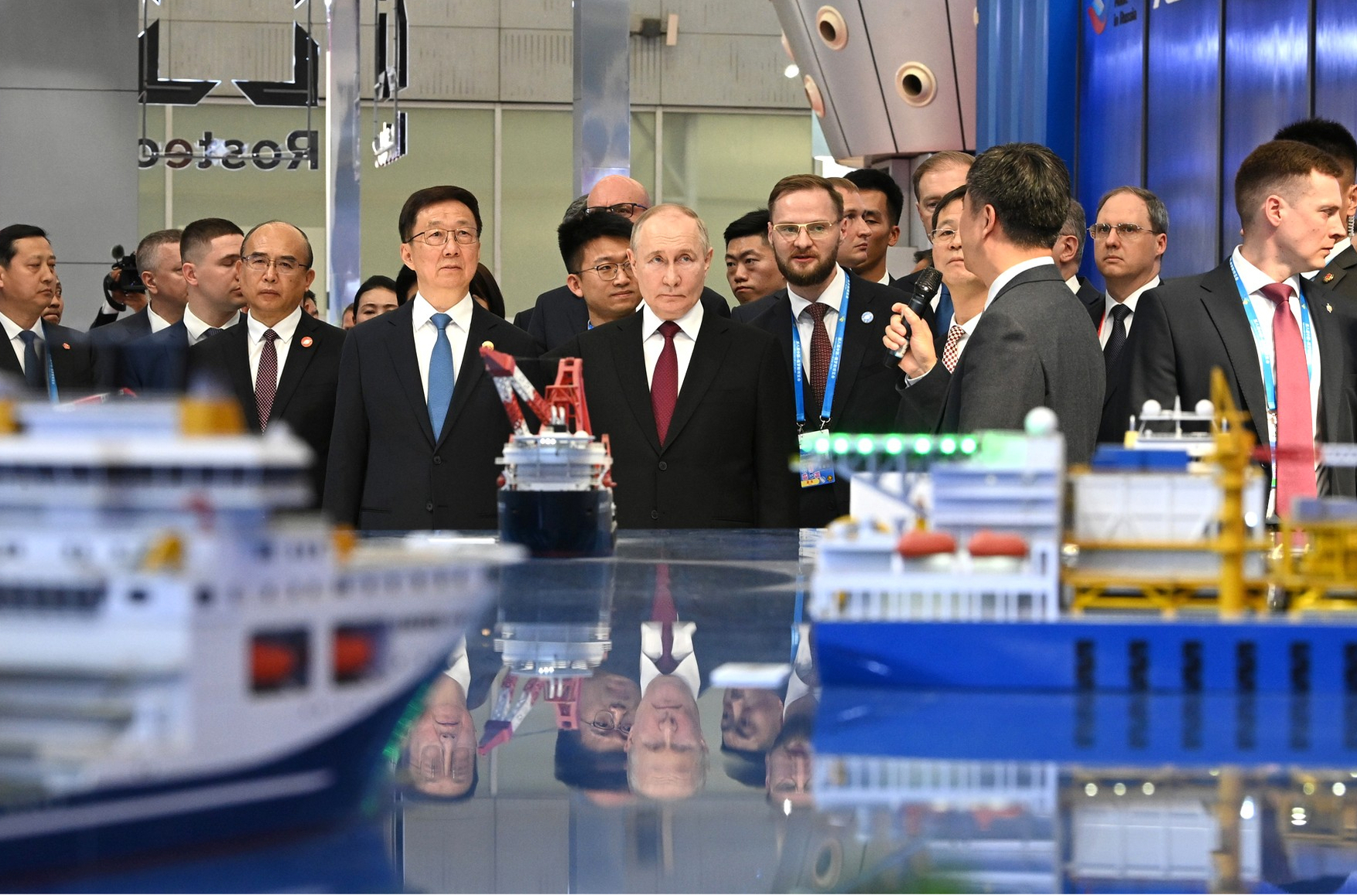

The unproductive meetings between the leaders of China and India with Vladimir Putin following his inauguration in May further indicate a cooling of relations. In such conditions, the question arises: Can Asian partners become a reliable support for the Russian economy, and can Asian suppliers effectively replace their European counterparts?

Dwindling supplies

In 2023, Russia's imports were higher than in 2022, nearly reaching 2021 levels in terms of total value. Imports from Europe decreased from $89 billion to $78 billion, while imports from Asia increased from $145 billion to $187 billion, suggesting that Russia might be able to obtain all necessary foreign trade goods from the East — if this trend continued.

However, everything changed in 2024. In the first five months of the calendar year, Russia imported a total of $108 billion worth of foreign goods, an 8.5% decrease compared to the previous year. Imports from Asia declined by 4%. If this trend persists, Asian goods will not be able to fully replace European products. This pattern holds true across all categories of goods and specific countries.

Russian imports from China in the first quarter of 2024 were similar to those in the first quarter of 2023, at around $24 billion. However, supplies began to decline in May, down 2% compared to May 2023. Imports from Turkey fell by 28% over the half-year, according to TurkStat. Surprisingly, in January-March, Turkey supplied fewer goods to Russia than Germany, which reclaimed its position as the second-largest source of Russian imports.

The companies are: Bomesc Offshore Engineering, Penglai Jutal Offshore Engineering, Wison Offshore Engineering Module Development, Qingdao McDermott Wuchuan Module Development, Cosco (Qidong) Offshore Company.

Countries from which more goods were imported in the first quarter: India, Malaysia, and Thailand.

Trade balance is the difference between exports and imports. It has a surplus if exports exceed imports, and a deficit when imports exceed exports.

In January-March, Turkey supplied fewer goods to Russia than Germany

Moreover, Turkish supplies to Russia are declining even more rapidly than German ones. In the first quarter of 2023, total imports from the three main partner countries amounted to $29.9 billion. This year, the figure is $28.4 billion, a decrease of 5%.

This indicates that imports from China have stagnated at the same time imports from “unfriendly” countries like South Korea, Japan, Hong Kong, and Taiwan, as well as from neutral Indonesia, are decreasing. Although other countries are increasing their supplies, they cannot compensate for the reduction from “pro-U.S.” Asian countries.

Half-hearted trade

Why are imports so crucial? Because exports, simply put, are produced so that an economy can purchase imported goods. If a state only exports without receiving anything in return, it is akin to the characters in Stanislaw Lem's story, who fed free food to a massive, ugly monster on their planet, believing this “export” was highly profitable for them.

Imports are especially vital in military and semi-military conditions, where control over physical resources is needed, and the benefits of owning international financial assets become somewhat uncertain. A country with a trade balance surplus essentially lends to its partners who have a trade deficit with it. This is exactly what Russia is doing with China, Turkey, Brazil, and especially India.

Russia sends 17 times more goods to India than it receives in return, resulting in its largest trade surplus. However, the Indian rupee is not a freely convertible currency, making it generally unprofitable to buy Indian goods with rupees and sell them outside India. Consequently, Russian oil suppliers are accumulating not very useful stocks of rupees in Indian banks. This issue remained unresolved during the visit of Indian Prime Minister Narendra Modi to Moscow.

The companies are: Bomesc Offshore Engineering, Penglai Jutal Offshore Engineering, Wison Offshore Engineering Module Development, Qingdao McDermott Wuchuan Module Development, Cosco (Qidong) Offshore Company.

Countries from which more goods were imported in the first quarter: India, Malaysia, and Thailand.

Trade balance is the difference between exports and imports. It has a surplus if exports exceed imports, and a deficit when imports exceed exports.

Russia sends 17 times more goods to India than it receives in return

Russia exports ten times more to Brazil than it imports from it and about five times more to Turkey, even when the “gray” imports resulting from sanctions evasion are taken into account.

“Trade with China is relatively balanced, but the issue lies in the one-sided dependence. China is Russia's top partner, supplying about half of Russia's imports. However, for China, the main sources of imports are Taiwan, followed by the U.S., South Korea, Japan, and Australia. Russia ranks sixth, accounting for just 5% of Chinese imports.”

Payments shall not pass

Russia’s situation is worsened by obstacles to making payments. The U.S. Treasury has warned Indian banks against engaging with the “Russian military-industrial base.” In June, the definition of this base was expanded to include Russian banks like Sber and VTB. Foreign banks that conduct transactions with these institutions face the risk of losing access to correspondent accounts in the U.S., which means losing the ability to use non-cash dollars.

This issue is even more critical for China than for India. Approximately 80% of yuan payments from Russia to China are rejected and returned, necessitating the use of intermediaries for Russian-Chinese transactions. These intermediaries sometimes include banks in Central Asian countries, but they also fear secondary Western sanctions and are rejecting about 30% of payments from Russia. As a result, payment schemes are becoming increasingly complex, slow, and costly.

Recently, The Insider reported that Taiwan's Giant Force had arranged a sanctions-evasion scheme in order to supply a Russian buyer with a crucial device for testing rocket casings. However, the arrangement, which involved a Chinese plant of the Taiwanese firm, a Malaysian transport company, and a Kyrgyz bank, failed due to cautious banks, including those in China. Fearing sanctions for exporting dual-use goods, these banks disrupted the transaction chain.

It appears that Asian countries are increasingly aware of the need to make a choice between one group of trade partners and another — either the West or Putin and his allies — and they are leaning towards the West. While this shift is unlikely to result in the same level of rupture as seen between Russia and the American-led Western bloc, it will likely lead to stagnation or decline in Russia’s trade and investment with Asia, rather than growth. The Russian economy is expected to experience slow but steady degradation, with purchases gradually decreasing while becoming ever more “gray.”

Faced with sanctions, Russian authorities have partially acknowledged that imports and international economic cooperation remain valuable even when conducted in the shadow sector, bypassing regulatory requirements, accurate reporting, and legal tax payments. New legislation has been approved allowing the use of cryptocurrencies for cross-border settlements in foreign trade agreements, making operations less transparent both to Russian authorities and to those imposing sanctions.

However, administrative pressure on businesses in this area has lessened. It will be challenging to reverse these fundamental changes — and there is always the possibility that the effects of this forced deregulation may outlast both the ongoing conflict and the current Kremlin regime. In short, Russia’s economic problems are unlikely to be solved anytime soon.

The companies are: Bomesc Offshore Engineering, Penglai Jutal Offshore Engineering, Wison Offshore Engineering Module Development, Qingdao McDermott Wuchuan Module Development, Cosco (Qidong) Offshore Company.

Countries from which more goods were imported in the first quarter: India, Malaysia, and Thailand.

Trade balance is the difference between exports and imports. It has a surplus if exports exceed imports, and a deficit when imports exceed exports.